Introduction

To some degree, currency risk is embedded in the portfolios of every international investor. So it’s surprising that such an important topic is often ignored, mismanaged, or misunderstood from both outside and inside the financial planning industry.Given that global currency movements are prominent in the headlines right now, it seems like good timing to have a quick review of currency risk, and safety-check that the currency exposure of our personal investment portfolio is in line with our objectives.

What Is Currency Risk and Where Does It Come From?

Most people who live and work internationally have experienced first-hand the impact of positive or negative currency movements; this is currency risk (also called exchange rate risk). Maybe you’re sending money home each month to pay your mortgage, and payments are easier than before because you get paid in a stronger currency. Or maybe your child wants to attend university in a country whose currency has appreciated against that of your savings, so it’s now more expensive. Or maybe you’ve just discovered that your holiday spending money will go twenty-percent further, because that eastern European currency has just plummeted.Exposure to currency risk occurs when your assets and income flows are valued in a different currency to your future liabilities and expenditure. If your asset currency strengthens or weakens against your liability currency, the liability becomes either cheaper or more expensive, respectively.

From the point of view of a typical investor, currency risk occurs when the currency of an investment varies against the reference currency. The reference currency is that of your future liabilities – it could simply be the currency of the country where you live now, or plan to retire (home currency); or, it could be some other target currency, such as the currency you need to pay education fees in.

It’s essential to identify what the underlying asset is, and what currency it’s valued in. Many types of investment are multi-tiered and can be available in different currencies, but currency risk derives solely from the valuation currency of the base asset.Identify The Base Asset Valuation Currency

Currency Risk Derives From The Valuation Currency Of The Base Asset

If you own an asset that’s valued in the same currency as your reference currency, then you don’t have currency risk. But if the asset is valued in a different currency, you do. For example, an investor based in Singapore, whose reference or home currency is SGD, will be exposed to currency risk by owning property in the UK. The market value of the property might rise by 10%, but if the GBP falls 10% against the SGD, then the net growth is zero measured in SGD.Similarly, a UK investor into the US stock-market will be exposed to currency risk - because US stocks are valued in USD, and the investor’s home currency is GBP. In this example, it makes no difference to the currency risk if those stocks are bought through an investment fund denominated in GBP (non-hedged). The underlying assets (stocks) are valued in USD, so that is where the currency risk lies.

You could buy through a fund denominated in pound sterling, euros, yen, or spondulis, it won’t affect currency risk which derives solely from the variation between the base asset (US stocks) valuation currency and the reference currency. The fund currency is transparent, and the currency risk is USD to GBP.

For another example, suppose you want to invest into a ‘BRIC’ emerging market investment fund. The fund will hold stocks listed in the four constituent BRIC countries – Brazil, Russia, India and China. Therefore, your currency risk will be between your reference currency and the four-R’s – Real (BRL), Ruble (RUB), Rupee (INR) and Renminbi (CNY).

If you are based in Australia and your reference or home currency is AUD, the currency risk lies in potential variations between the AUD and each of BRL, RUB, INR, CNY. It does not matter what currency the investment fund is denominated in.

By way of illustration, let’s look at the iShares BRIC 50, an exchange traded fund. The fund tracks an index of the largest 50 companies from the BRIC nations. There are four currency versions of the fund - USD, GBP, EUR and CHF. The chart below shows the 5-year performance of each fund, in its main denomination currency.

Figure 1 – iShares BRIC 50 ETF in four currency versions

Looking at the chart, you might be tempted to think, “Well, I’d definitely buy the GBP version of the fund, because the performance is better than the others, especially the USD fund.”

But wait. Here are two important points to consider:

1. The differences in performance are entirely due to the relative variation of the base asset currencies (BRL, INR, RUB, CNY) against the fund denomination currencies. (In this case, over the last 5 years the GBP has performed much worse than the USD, against the basket of BRIC currencies.)

2. If you rebase the funds to the same currency (any currency), the performances will be near identical. Here’s the four funds all plotted again, re-based to AUD.

Figure 2 – iShares BRIC 50 ETF in four currency versions, rebased to AUD

As clearly demonstrated – for our Australian investor, the currency risk comes purely from the variation between the base asset valuation currencies, and the reference currency. It doesn’t come from anywhere else, and it doesn’t matter what currency the investment fund happens to be denominated in. This is crucial to understand if you are an international investor.

In the above example, even if the investment fund you use is denominated in AUD, it will not mitigate your currency risk – because that arises solely from the valuation currencies of the underlying stocks.

The above discussion is applicable to equity investments, because your money is fully invested in share-ownership of the companies that are held by the fund. In a moment I’ll discuss the implications of funds that hold cash or bonds, but first let’s discuss currency-hedged funds.

Using Currency-Hedged Funds To Reduce Investment Risk

As we saw above, currency risk in international investing is inherent in any portfolio that holds assets valued in a currency that is not the reference currency of the investor. If we’re concerned that the downside risk outweighs the upside, we might decide to use an investment that is ‘hedged’ back to our reference or home currency.Currency hedging removes the effect of exchange rate changes on the performance of our investment, when measured in our home currency.For example, suppose an investment with assets valued in currency XXX grows 20% in a year. A version of this fund hedged to currency YYY would deliver the same performance – 20% - regardless of any variations in the XXX/YYY exchange rate over that time.

Currency hedging is carried out using financial instruments such as futures and forward contracts, which have a cost. Therefore, currency-hedged funds typically don’t reflect the exact performance of the underlying assets (though can be very close).

Currency Hedging Can Sometimes Be Useful

An American investing in a portfolio of international stocks will have currency risk against the basket of international currencies in which those stocks are valued.For example, a simple way to get exposure to the non-US developed market is through the iShares MSCI EAFE ETF (Europe, Australasia & Far East). This popular USD denominated exchange traded fund has delivered 13% returns in four years. It doesn’t seem like much, considering the fund tracks the index of developed markets outside of north America. But the problem has been the appreciation of the USD against the mix of currencies of the underlying investments.

If an investment in local currency grows by 10%, but the currency weakens by 5%, then you net only 5% in your home currency. Alternatively, an investor anticipating a strengthening of the USD against other major currencies, might have used a currency-hedged version of this fund. This means that X% returns of the underlying investments deliver X% returns in USD, regardless of foreign exchange rate fluctuations.

The chart below shows both versions of the fund, hedged and non-hedged. The currency hedged fund has delivered 35% returns over the same four-year period – i.e. 22% more than the non-hedged. This difference reflects the strengthening of the USD against a basket of international currencies over that period.

Figure 3 – iShares MSCI EAFE ETF hedged vs unhedged

But Currency Hedged Funds Don’t Always ‘Work’

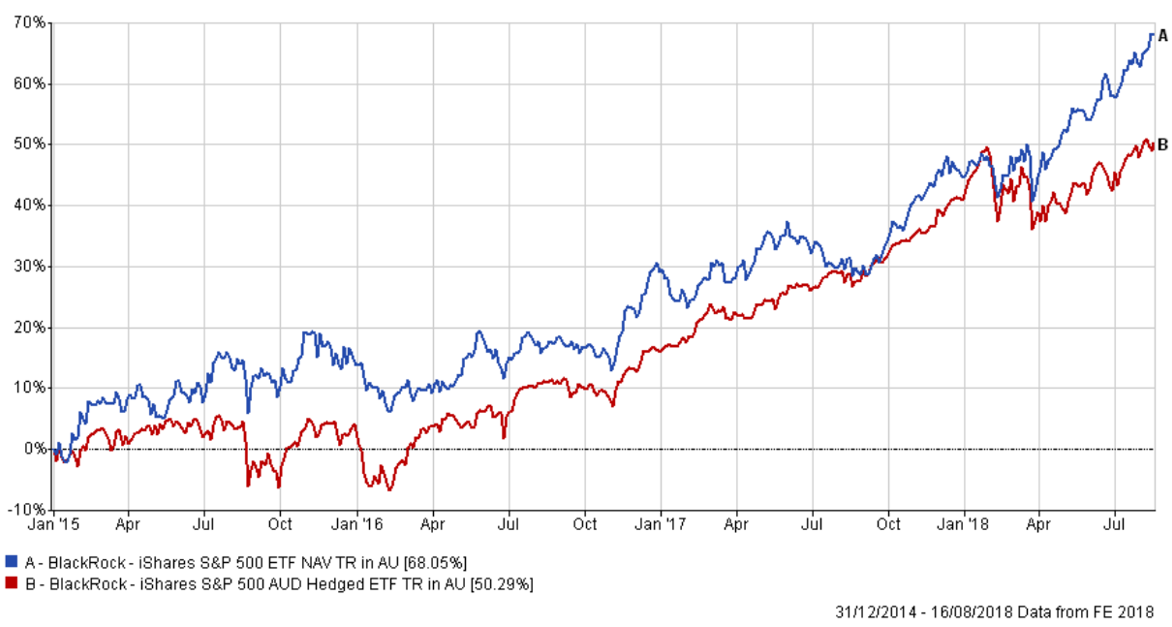

Because exchange rate variations can swing in either direction, currency ‘risk’ can work for you, as well as against you.For example, an Australian investor into the USA stock-market will have currency risk, because US stocks are valued in USD, but the investor’s home currency is AUD. In USD terms, the iShares S&P500 ETF has delivered about 50% growth from 1st January 2015 to date (18th August 2018).

But suppose back at the start of 2015, our investor was nervous about USD-AUD currency risk, and decided to use the iShares S&P500 AUD Hedged ETF. An investment in this fund would have delivered exactly the same percentage growth, 50%, in AUD terms.

But what our hypothetical investor didn’t know, is that the USD would continue to appreciate against the AUD. If he or she had simply stuck with the USD denominated version of the fund, he would have received returns of 68% in AUD terms. In other words, by using a currency hedged fund to remove risk from the USD-AUD exchange rate variations, the investor has sacrificed 18% potential gains when measured in his home currency.

The chart below shows both the hedged and non-hedged versions of the fund.

Figure 4 – iShares S&P 500 ETF unhedged vs AUD hedged

This example highlights the strategic dilemma regarding use of currency-hedged funds. Currency movements are notoriously difficult to predict. Poorly considered use of currency-hedged funds is the same as playing the forex market, which is a great way to lose money.

Ermm, So Should We Use Currency Hedged Funds, Or Not?

The key is in the word ‘hedged’. Hedging means to reduce risk; and as mentioned, hedging carries a cost – much like an insurance policy. A time to use currency hedging might be either:1. You have a short- to medium-term view and want to protect against downside currency movements against your reference currency. Probably because you need to withdraw cash from your investments, in your target currency and at a specific time. The ‘cost’ of hedging is not just that a hedged fund may not deliver fully all the gains, but you will be sacrificing the potential upside should currencies move in your favour; or;

2. You have a medium- to long-term view and have a strong opinion about a currency movement trend over that period. For instance, in recent years, astute political and economic observers might have hedged into the appreciating USD, or away from depreciating GBP.

Having identified when an average investor might be tempted to use currency-hedged funds, I will now explain why I almost never recommend them.

In the first scenario, the supposed reason for using currency-hedged funds is that you want to withdraw cash in your target currency at some point in the near to mid-term. In this case, I normally suggest to clients to use the ‘safe and steady’ part of their portfolio – bonds and fixed income – to hold the currency they wish to withdraw.

For example, if you know in two years’ time you need GBP to send your child to university in the UK, then make sure the safer (less volatile) part of your portfolio is in GBP, by holding sterling bond funds.

In the second scenario, the supposed reason for using currency-hedged funds is that you have a strong opinion about a trend in currency movements. The problematic part of this scenario is that your opinion needs to be right.

Currencies strengthen or weaken against their peers for a myriad of reasons, many of which are not predictable because they stem from decisions of politicians and central bankers. Recall my remark earlier about the forex market being a great way to lose money.

Fundamentally, an expanding economy tends to be associated with a strengthening local currency, because economic activity, inward investment and rising exports increase the demand for the local medium of exchange. Hence, the average international investor may be better served by a neutral strategy and a long term view – specifically, let our portfolio’s asset allocation do the work for us.

If we are tilting our portfolio a little towards regions that have a higher growth expectation, then we have in-built exposure to a mix of currencies that are more likely to appreciate against the global currency basket. No hedging required.

Currency Risk Of Bond and Mixed-Asset Investment Funds

As mentioned earlier, the above discussion focuses principally on equity funds, where the underlying assets are stocks valued in the listed currency. But what is the situation when investment funds hold cash, bonds or other fixed-income assets?If you invest in a fund that happens to hold 30% cash, then obviously the valuation currency of that asset (cash) is known. Similarly with bonds, which are always valued in a specific currency.Well, the rule still holds true – currency risk derives from the valuation currency of the base assets, versus your reference currency.

Bonds are a debt instrument, in that you lend money to a government or company, which they will pay back sometime in the future. In the meantime, they pay you a periodic income being a small percentage (‘coupon’) of the amount of the loan. Therefore, when building your investment portfolio, bonds can be considered ‘cash-like’.

If you are a relatively cautious investor, and consequently hold a sizeable portion of your portfolio in cash or bonds, you should pay special attention to the currencies involved. If you have a short time horizon, or are close to retirement, a large percentage of your cash and bonds should be in your target or home currency.

If you have a longer time horizon, you may decide there is no reason to hold so much ‘cash’ in a single currency, and opt to diversify the currencies of your bond assets, in the same way you do with your equity assets.

This is particularly relevant for international citizens who are planning for a multi-national lifestyle in the future. Planning to live the summer months in UK, but winter in Australia? You have two reference currencies, not one.

A mixed-asset (or multi-asset) fund is one where the managers are allowed move your money between the different asset classes such as cash, bonds, equities, and property. They may have guideline percentages for each class, but can vary the mix depending on market conditions. This can be an advantage when markets are volatile, because if things get scary they can sell out of equities and move to cash quickly, on your behalf.Holding Multi-Asset Investment Funds? Check The Asset Currencies!

When constructing your portfolio, it’s essential you understand what currencies you’re exposed to through the cash and bond holdings of any mixed-asset fund you have invested in. Make sure that those currencies are appropriate to your overall strategy. This data is usually available to investors and financial advisors through investor information websites, fund fact-sheets, and online tools.

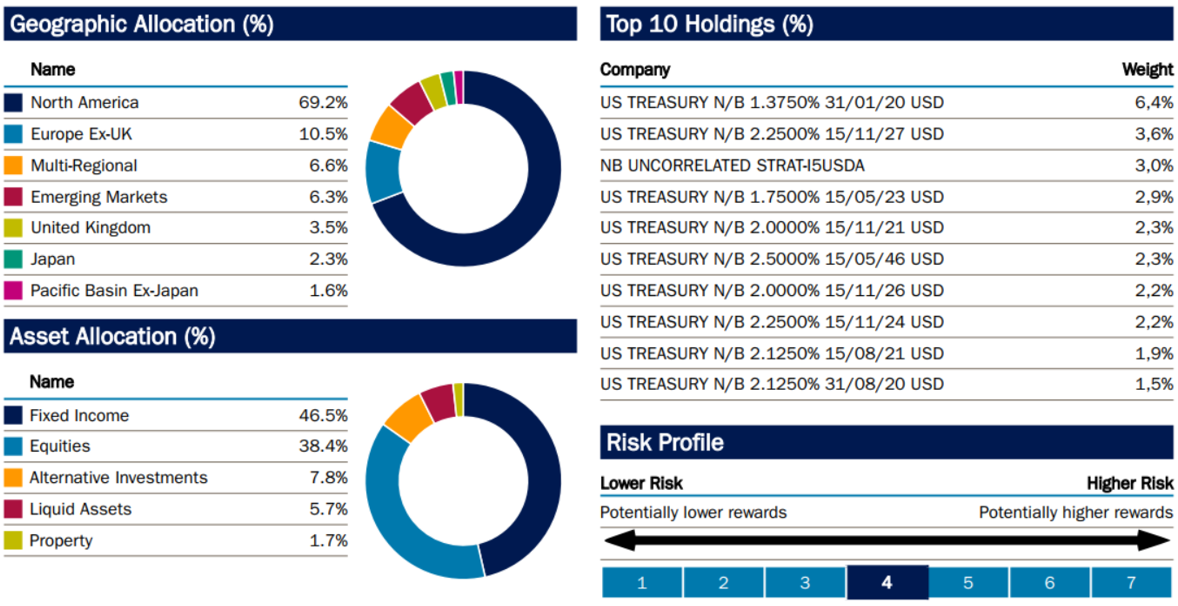

For example, the Sarasin GlobalSar Strategic fund – a balanced mixed asset fund – is available in three currencies, USD, GBP, and EUR. Here’s the holdings breakdown for the USD denominated fund.

Figure 5 – Sarasin GlobalSar Strategic Fund USD – holdings breakdown

We can see right away that this USD version of the fund is appropriate for investors with a USD reference currency. Almost 70% of geographic exposure is to North America, and all the top bond holdings are USD denominated, mostly treasuries.

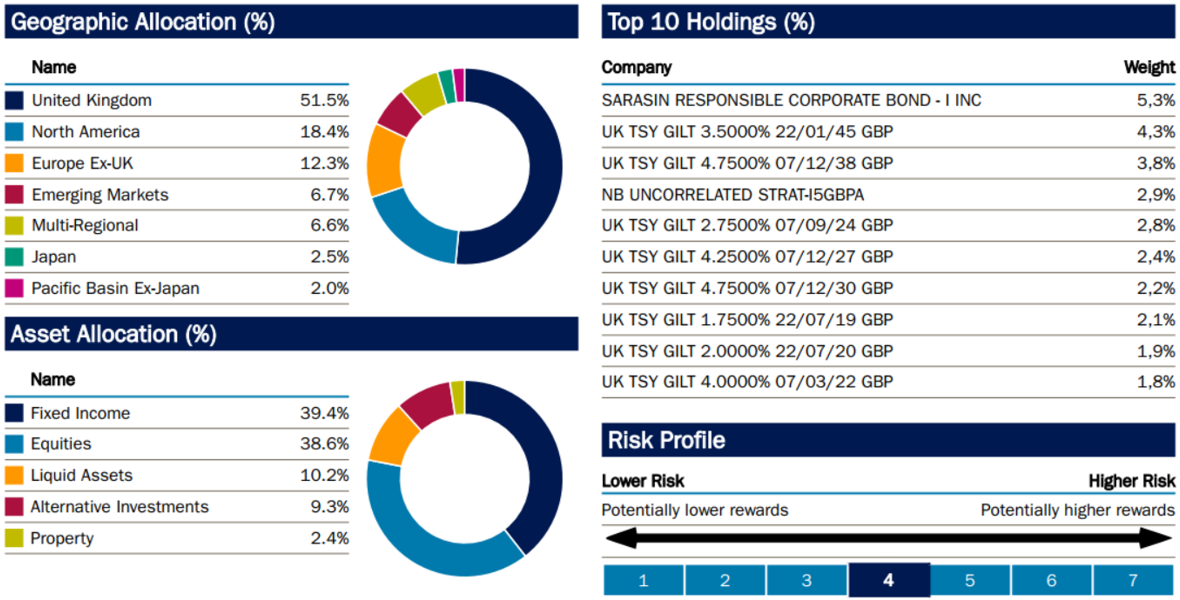

Here’s the breakdown for the GBP fund.

Figure 6 – Sarasin GlobalSar Strategic Fund GBP – holdings breakdown

Similarly, we see the GBP version of the fund is appropriate for an investor with a GBP reference currency. More than 50% geographic exposure to the UK, and all the top bond holdings are GBP denominated, mostly UK gilts.

These two breakdowns are great examples of how professional fund managers take account of their investors’ reference currency, when building their fund asset allocation.

Concluding Summary

If you’ve read through my article and made it this far, many thanks for your perseverance. If you’ve skipped to this point, that’s fine too. Here are some concluding bullet points:1. Having a currency strategy is important when building your investment portfolio, even if that strategy is mostly neutral, and you decide to let the asset allocation do the work for you.

2. Currency risk arises exclusively from potential variations between your reference currency and the valuation currency of the underlying assets you hold in your portfolio.

3. This means the currency risk of equity investment funds derives from the currency of the stocks held. It does not come from the currency that the fund happens to be denominated in.

4. Specifically, it is a dangerous myth that buying investment funds only in your home currency will mitigate currency risk.

5. The currencies held in the cash and bonds part of your portfolio are much more important to pay attention to. They should match your reference currency for short time horizons, and possibly carry some diversification for long time horizons.

6. Overall, using currency-hedged equity funds probably doesn’t give much strategic advantage for the average investor. We should trust in the logic of diversification, and not attempt to predict the forex markets.

7. When buying mixed-asset funds, make sure to burrow down into the detail and check that the cash and cash-like holdings are currency-appropriate for you.

No comments:

Post a Comment

Roy says: "Thanks for taking the time to leave a message, comment, or continue the conversation!"