Updated 1/8/2018. Most of us try to avoid thinking about ‘worst case scenarios’. But sometimes we need to. Employer benefits such as ‘death in service’ insurance can lull us into a false sense that everything is taken care of.

Updated 1/8/2018. Most of us try to avoid thinking about ‘worst case scenarios’. But sometimes we need to. Employer benefits such as ‘death in service’ insurance can lull us into a false sense that everything is taken care of.

Download the Insurance Needs Calculator.

When I sit down with new clients and work out the cover they actually require, many people find they are drastically under-insured.

Moreover, statistically we are much more likely to be hit with a serious illness, and survive, than we are to die before the age of 65.

Making sure you have planned for that 50/50 likelihood is essential; if the worst happens, you want to be able to focus on recovery, instead of stressing about finances.

Rule #1 – Plan for the Worst Case Scenario

We insure our house, our car, maybe even our mobile phone. To not adequately insure ourselves – the family’s most valuable asset – it’s worse than illogical, it’s downright scary.Contingency planning is not optional. We don’t know what the future holds. If you have family relying on you – whether as provider, or parent, or both – you have an obligation to make sure your dependents are ‘going to be ok’ financially if something happens to you.

Don’t Rely Solely on your Employer’s Cover

Many professionals have some form of life insurance provided by their employer - called ‘death in service’ benefit. A typical cover value is 3 to 4 times salary.The problem is, because that sounds like a lot of money, we don’t bother to work out the true amount of insurance protection we actually need.

Furthermore, if you are made redundant, or change jobs to a firm that offers no life cover benefits, you can find yourself suddenly uninsured (or worse, uninsurable) through no fault of your own.

Hence, your baseline life insurance should be owned by you and not your employer.

Work out the Life Insurance Cover You Actually Need

The purpose of life insurance is to fulfil your financial responsibilities if you die. Therefore, the first step is to get a measure of those commitments.Lump Sum Responsibilities

You should plan your finances so that if you die then all major debts are covered, and all important future expenditures are accommodated. Several of the following are likely to apply:- Remaining mortgage on your home

- Sum to cover 4 years of university fees and living expenses for each child

- Sum to pay off car loans and other debts (*essential* in UAE)

- Sum to cover expenses for your family to move back home if you are an expatriate

- Sum to cover funeral and associated costs

- Sum to cover estate duties or inheritance taxes (so that your family receive the full value of the assets you wish to pass on to them)

Income Responsibilities

After the essential debts are paid, and funds set aside for future events such as university fees, the remainder of your insurance payout should be enough to provide an income to cover your family’s basic living expenses (as a minimum) for several years into the future.Using your current monthly expenditure as a guide, think about what annual income would be needed to make sure your family can live an appropriate lifestyle, and for how many years before they’re ‘on their own’.

Make sure to cover the Most Important Person!

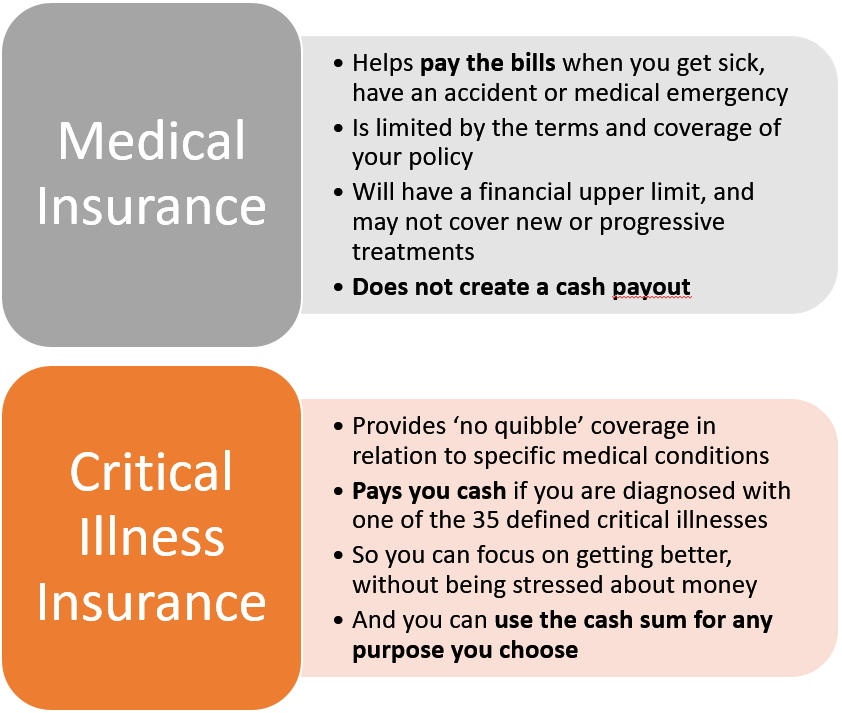

If you have children, then life insurance cover of the primary homemaker is essential, to give the surviving parent the option to stop work for a period and focus on taking care of the family at such a stressful time.Your Need for Critical Illness Cover (Not to be confused with medical insurance - see below)

People are living longer. The average lifespan of men and women is steadily increasing because of numerous factors - healthier lifestyles, nutritional factors, and even simple genetics. Also, of course, the incredible advances in medical fields such as diagnostics, pharmaceuticals, and surgical techniques amongst many others. Diseases and conditions that two decades were a death sentence are now quite survivable.But staying alive does not necessarily mean recovery or timely return to work. Often, quality of life is impaired. Recuperation might take an extended period. Or perhaps treatment needs to be ongoing. There may be a need for lifetime care. Either way, there is a significant chance that life won’t return to how it was before.

Statistically, we are much more likely to be affected by a so-called ‘dread disease’ and survive, than we are to actually die during our working life.

What happens if you have an accident, or acquire a medical condition, that means you cannot work?

Life-impacting changes such as these can be a major shock – not just in financial terms, but in the practical side of day-to-day living.Whether you’re single or married, the loved ones around you will be affected. Who’s going to look after you? How will that affect their lives, and will they need to stop work themselves to do so?

Maybe you’re the main breadwinner - in that case, will your spouse need to go back out to work, to support things financially? If so, how will care of your children be affected?

The Purpose of Critical Illness Cover

Critical Illness Cover (CIC) pays out a lump sum if the person insured is diagnosed with one of a defined list of critical illnesses, disablements or medical interventions. These are for example: major cancers, heart attack, coronary artery by-pass surgery, stroke, Parkinson’s disease, and blindness, amongst others.CIC is not designed specifically to cover costs of medical treatment - that’s the purpose of health insurance.

The objective of CIC is to provide a lump sum to (i) soften the financial impact of the life changes that must be made when trying to cope with a major illness, and (ii) funds to cover loss of income during treatment and recovery.This could be, for example, the cost of repatriation, the cost of changes to family living arrangements, enough to support school fees, mortgage etc., while you cannot work, the cost of an attendant carer and/or housekeeper, a sum to cover general lost income, or to pay off debts, for example.

Stop!

Do not skip over this section if you live in UAE!If you have any kind of debt that would be difficult to cover if you had to stop work through illness, you need Critical Illness Cover. Defaulting on debt can lead to both civil AND criminal penalties (i.e. prison time) in the UAE.

What Conditions are Covered by Critical Illness Insurance?

Here is a typical list. Note that each provider has specific criteria and you should familiarise yourself with the details of your chosen policy.

Alzheimer’s disease or dementia before age 65, Aorta

graft surgery, Aplastic anaemia, Bacterial meningitis, Benign brain tumour with

permanent symptoms, Blindness, Cancer excluding less advanced cases, Chronic

organic brain disease before age 65, Coma, Coronary artery by-pass grafts, Creutzfeldt-Jakob

disease, Deafness, Encephalitis, Heart attack, Heart failure of

specified severity, Heart valve replacement or repair, HIV infection from blood

transfusion, Impairment of daily activities through permanent disability before

age 65, Kidney failure, Liver failure from advanced liver disease,

Loss of limbs (hands or feet), Loss of speech, Major organ transplant, Motor

neurone disease, Multiple sclerosis, Open heart surgery, Paralysis of limbs, Parkinson’s

disease before age 65, Progressive supra nuclear palsy, Respiratory failure from

advanced lung disease, Severe mental illness, Stroke, Systemic lupus

erythematosus, Third degree burns covering a specified proportion of the body's

surface area, Traumatic head injury.

No comments:

Post a Comment

Roy says: "Thanks for taking the time to leave a message, comment, or continue the conversation!"