The biggest financial event in our lives is retirement; but many people spend more time planning for their summer holiday, than they do for their years after stopping work.

Do you know “what’s your number”?

What income will you need in retirement? What financial resources should you have? How can you make sure you don’t run out of money? What should you be doing about it now?

Understanding the Cost of Delay

Working out what income you'll need when you retire, and what size pension pot you'll need to fund that income, is straightforward. But because 'retirement' seems like a long way off, many of us don't get around to planning for it. Unfortunately, delay can be costly.For example, suppose you wanted to build a retirement fund of $1 million by the time you’re 60. If you were starting from scratch, how much should you save each month?

Monthly savings needed to grow $1 million by age 60 (at 7% annualised growth)

What the table above shows is that if you have thirty years ahead of you, then saving $850 monthly would allow you to build a $1,000,000 retirement fund. But it you delay by just five years, you'll then need to save $1,269 monthly to hit the same target. i.e. in this example:

.. a delay of five years means you need to save 50% more each month, for your entire working career.

What's a General Guide for How Much I Should be Saving?

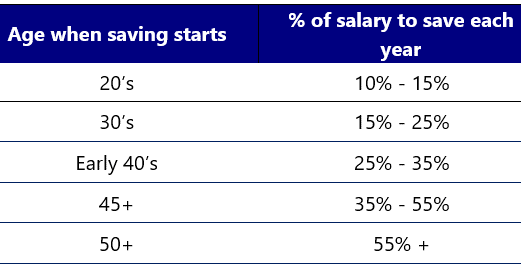

If you haven’t yet started to save for your retirement, the following can be used as a basic guideline, based on some typical assumptions, including:

- You plan for 80% replacement of pre-retirement pre-tax income, adjusted for inflation and with a high likelihood of being sustained for up to 30 years (retirement at age 65)

- State pension or other income will provide 25% of your retirement income needs each year

Starting early is important, because once you start, the same savings goal applies until you retire. For example, if you start saving roughly 12% of your income in your mid-20s and have the discipline to maintain your savings plan, you shouldn't have to increase that percentage as you go through your 30s, 40s and so on.

The above table is of course just a general guideline - a rule of thumb. The key essentials are:

- Start early and save what you can afford, when you can afford

- Make your money work hard for you through a diversified range of investments

- Review progress against targets on a regular basis, and adjust as required

Contact me for a no obligation discussion and planning session on how best to achieve your future financial goals.

No comments:

Post a Comment

Roy says: "Thanks for taking the time to leave a message, comment, or continue the conversation!"