Being a country fair, about 800 people entered a weight-guessing competition – the object in question was a fat ox, and entrants were invited to guess it’s weight after it had been slaughtered and ‘dressed’.

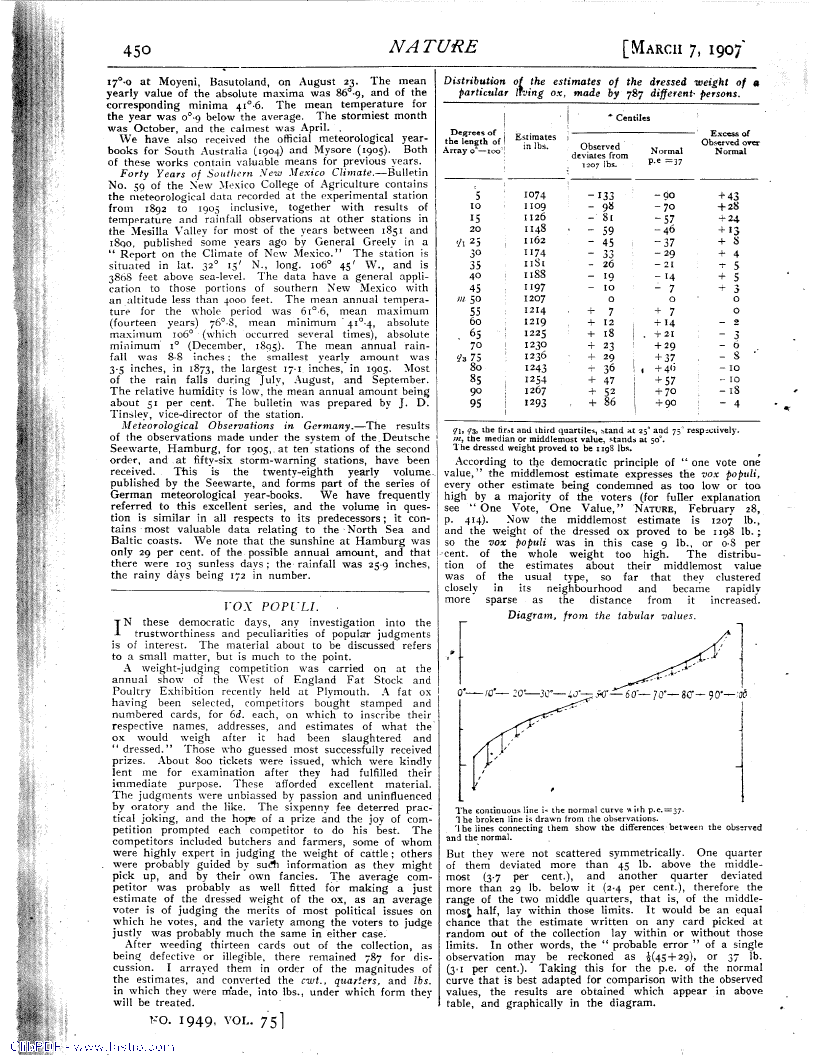

Now, it turns out that of all the expert butchers, farmers, and presumably many other non-expert folks enjoying a day out, nobody guessed the correct answer. However, the average of all the answers was almost exactly correct (and furthermore the guesses were normally distributed about the correct figure).

Galton called this effect ‘democratic judgment’, and reported his results in his paper ‘Vox Populi’ printed in Nature, March 1907. He demonstrated that a sufficient number of participants, all making their own independent judgments, can individually be mostly wrong, but collectively be extremely accurate.

A simple version of this experiment is to imagine a hundred people being asked to guess the number of beans in a jar – most will be quite wrong, but statistically the likelihood is that the average will be spot on. (This subject is explored fully in James Surowiecki’s book ‘The Wisdom of Crowds’.)

So we see that if the number of participants is the huge volume of buyers and sellers in an equity market, then the ‘correct’ price of a stock must be the present one, chosen by the crowd and currently reflected in the market.

And the idea that we can outguess or time the market, or find hidden nuggets of stock opportunities that millions of others have missed? Well, even the so-called experts have a hard time doing that.

Better to go with the crowd, than against it - that's why index-tracking investment funds exist.

No comments:

Post a Comment

Roy says: "Thanks for taking the time to leave a message, comment, or continue the conversation!"